If Joe Biden and Kamala Harris proposed to give taxpayer funds to pro-tax, pro-spending groups like the Center for American Progress or the Center on Budget and Policy Priorities, Republicans presumably would argue against handouts.

After all, why should taxpayers be forced to subsidize left-wing activism?

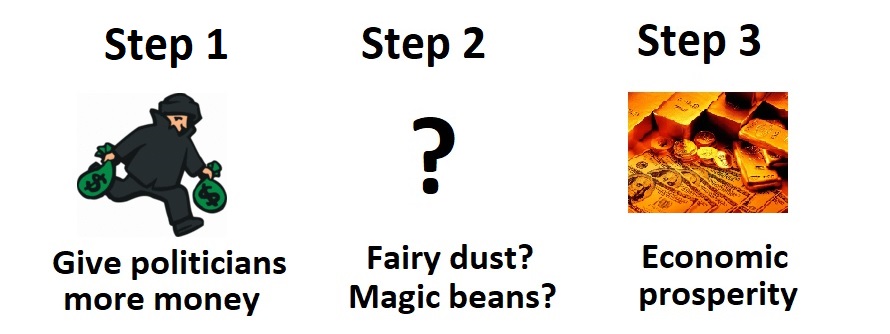

While this sounds like a strictly hypothetical question, the sad reality is that American taxpayers already are funding a group that pushes for higher taxes and bigger government.

While this sounds like a strictly hypothetical question, the sad reality is that American taxpayers already are funding a group that pushes for higher taxes and bigger government.

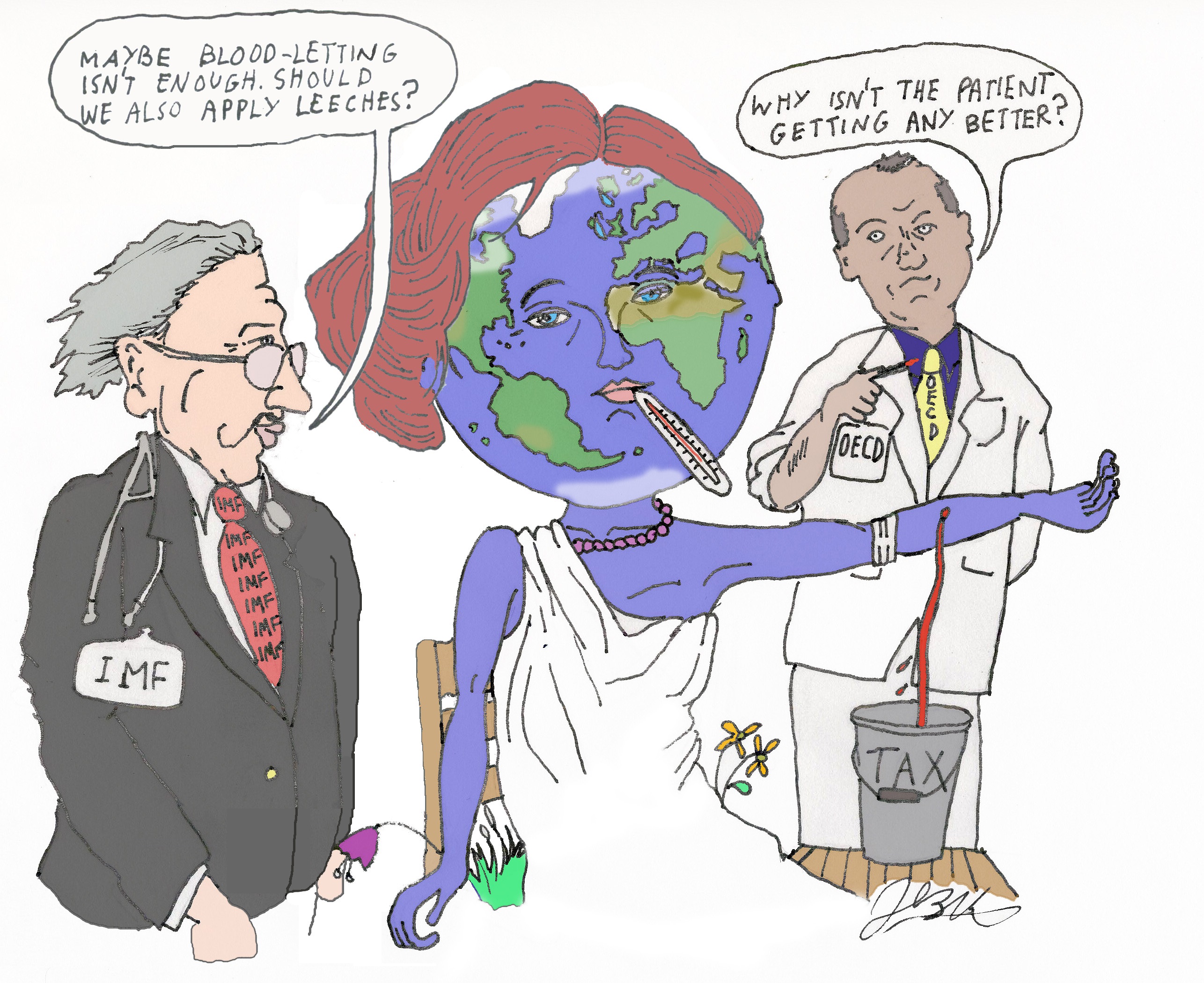

The Organization for Economic Cooperation and Development is a Paris-based international bureaucracy that is dominated by Europe's welfare states.

For decades, the OECD has pushed for policies for all sort of tax increases. The bureaucrats mostly push for class-warfare policies (higher income tax rates, higher capital gains taxes, higher death taxes, higher business taxes, etc), but the OECD also doesn't hesitate to push for taxes that would pillage ordinary people (energy taxes, value-added taxes, etc).

Just a few days ago, the OECD stayed true to form with a new report urging more class warfare.

This report...explores how tax systems can mitigate...inequality with a focus on the distribution of income and wealth and identifies scope for potential reform. ...Strengthening progressivity through domestic tax systems can take the form of setting more progressive tax schedules, broadening the bases of progressive taxes... Improving equity calls for increasing overall tax revenues... International tax collaboration can empower countries to more effectively implement their domestic tax policies. Progress in international tax transparency...has significantly strengthened the effectiveness of domestic taxation and gives governments new scope to tax capital.

In addition to a generic embrace of various class-warfare taxes, the OECD also could not resist marrying demagoguery with dishonesty (an OECD trait) when analyzing the taxation of income that is saved and invested.

In many countries, capital income receives more favourable tax treatment than labour income.

This is simply not true. The OECD bureaucrats are ignoring the fact that various forms of capital income (such as dividends and capital gains) are examples of double taxation.

If the corporate income tax is included, the overall tax burden on capital is higher than the tax burden on labor (as the OECD itself has acknowledged on multiple occasions).

Defenders of the OECD will claim I'm being unfair because the report explains that policy makers should be aware of "incentives to work, save and invest, and ultimate implications for economic growth."

Yet that is just a throwaway line. To the extent that the report mentions growth, the OECD implies that more class warfare will, "mitigate inequality and support more inclusive growth."

Ironically, the political types at the OECD routinely assert that higher taxes and bigger government will be good for prosperity even though the professional economists in Paris produce research showing the opposite is true.

The bottom line if that Republicans should have defunded the OECD a long time ago. But that apparently is asking too much of the "stupid party."

No comments:

Post a Comment