When I list the principles that should guide tax policy, that almost always means these three goals.

And I usually then point out that achieving these goals will get you to (or at least close to) a simple and fair flat tax.

But there are some other design considerations for a tax system. Some of them are wonky, such as territorial taxation vs. worldwide taxation or depreciation vs. expensing.

But there's also a very basic design issue dealing with the amount of income families can earn before they start paying income tax (among tax nerds, this is sometimes known as the "zero bracket amount").

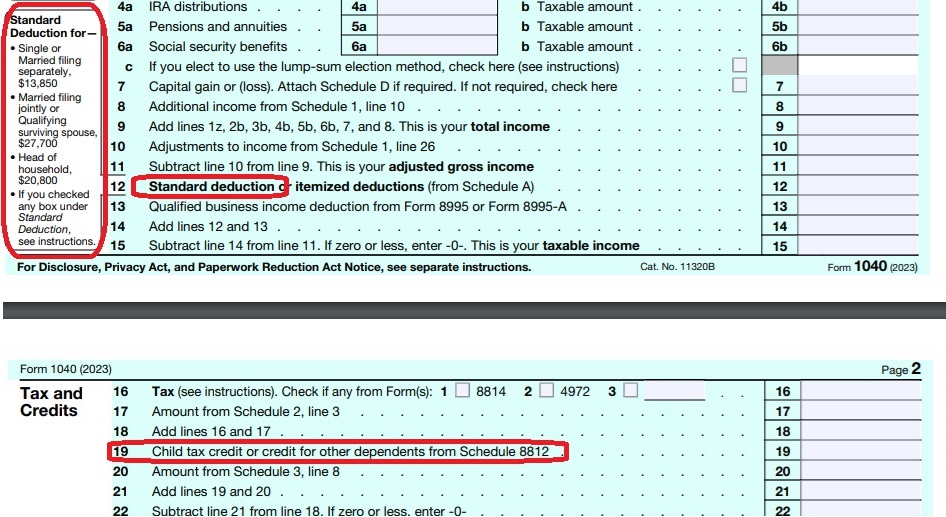

At the risk of oversimplification, the zero bracket amount is governed by the type of household (such as married or single) and the number of children. Here's a screenshot of the relevant parts of the IRS 1040 form.

To summarize, you get to reduce your taxable income based on the type of household, and you then get to reduce your tax bill based on the number of children.* The combination of those two things determines how much income you can earn before Uncle Sam starts taking a slice.

As you might expect, there's a controversy over the zero bracket amount. Is it too big or too small? Is the tax credit for kids too high or too low?

For a libertarian, the answer is easy...and difficult.

The easy part of the answer is that we want less money going to government, so we want the biggest-possible standard deduction and the largest-possible child tax credits.

The hard part of the answer is that we also worry about what happens when a big share of the population doesn't pay income taxes. If some people don't have to pay for government because all their income is free from tax, the concern is that they might then want more government.

Libertarians also worry that providing larger deductions and credits will crowd out other tax cuts that would be much better for the economy (and much better for workers and families in the long run, as explained in Part I of this series).

But the biggest problem, in my humble opinion, is that politicians are expanding the welfare state with "refundable tax credits."

That sounds like jargon, but all you need to know is that refundability means that some households get money from Uncle Sam even if they paid no income tax. In other words, the tax code is being used as a tool for income redistribution.

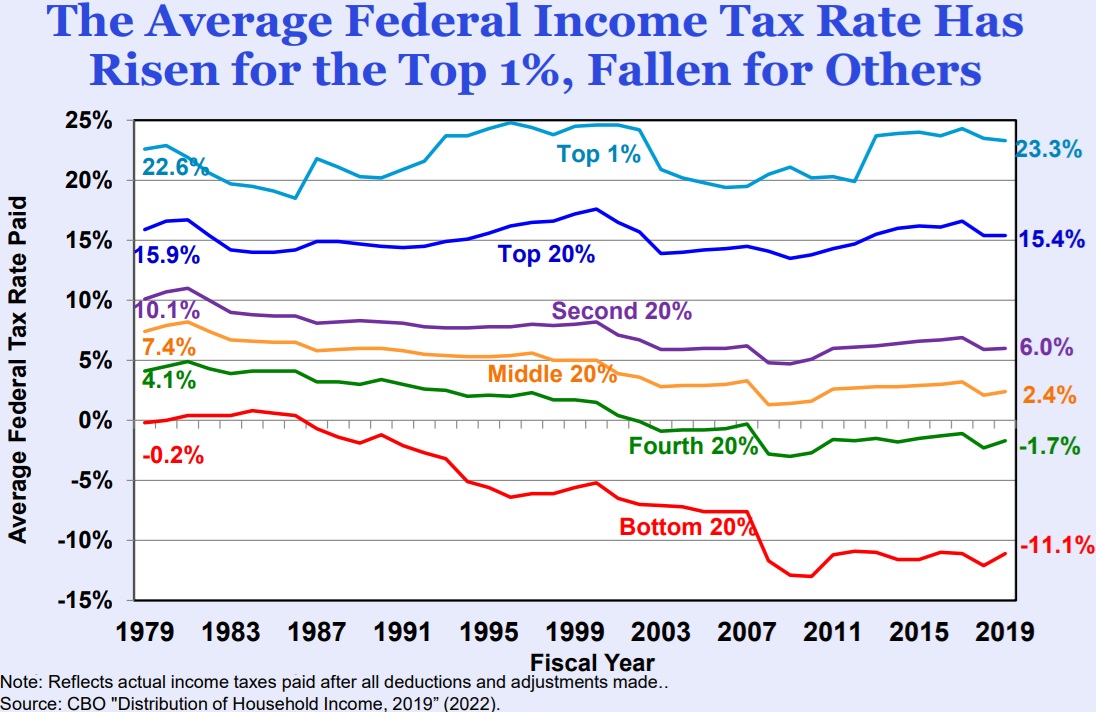

By the way, this is not merely a theoretical concern. Here's a chart from Brian Riedl showing that redistribution in the tax code is now so prevalent that the bottom 40 percent of taxpayers get handouts when they file their taxes.

The Wall Street Journal recently opined about this problem. Here are some excerpts.

J.D. Vance went on TV and endorsed raising the amount to $5,000 per child. Mr. Vance is putting himself into a bidding war against Ms. Harris, using taxpayer money. ...during the pandemic Democrats bumped up the benefit to $3,600 for young children. The credit now is $2,000, and under current law it will revert to $1,000 in 2026. Mr. Vance offered few other details but suggested he wanted a near-universal entitlement. ...A universal credit would have to be refundable, which means the government would write a check even to those who don't pay income tax. This year the credit is refundable only up to $1,700, but Democrats want total refundability as the start of a universal basic income, whether you work or not. ...one more giant item mucking up the tax code while producing zero of the economic growth that such families need to prosper. The rough cost of this big new entitlement could be nearly $3 trillion over 10 years... This would crowd out fiscal and political space for extending the 2017 tax cuts.

Mr. Vance offered few other details but suggested he wanted a near-universal entitlement. ...A universal credit would have to be refundable, which means the government would write a check even to those who don't pay income tax. This year the credit is refundable only up to $1,700, but Democrats want total refundability as the start of a universal basic income, whether you work or not. ...one more giant item mucking up the tax code while producing zero of the economic growth that such families need to prosper. The rough cost of this big new entitlement could be nearly $3 trillion over 10 years... This would crowd out fiscal and political space for extending the 2017 tax cuts.

For what it's worth, I'm largely agnostic about the level of the zero bracket amount. I prefer pro-growth reforms, but I also recognize that it makes sense to let families earn a decent amount before they get hit by the income tax.

I'm much more interested in stopping refundability. Simply stated, I don't think the tax code should be used as a tool for income distribution. In part because redistribution is bad economics and in part because this is an area that should be reserved for state and local governments.

I'll close with one more excerpt from the WSJ editorial. We actually already had a fight about whether to massively expand refundability. A huge per-child handout was included in Biden's fake stimulus back in 2021.

But the handouts were for only one year. The left assumed there would be public pressure to make them permanent. But that did not happen.

One of the wonders of recent political times was that the Democrats' pandemic expansion of the child tax credit to $3,600 expired with barely any public protest. Americans still prefer opportunity and rising wages to income redistribution.

Letting these handouts lapse was a great victory for fiscal responsibility.

*A credit is more valuable than a deduction. A $1000 tax credit means you get to reduce your tax bill by $1000. A $1000 deduction, by contrast, means you get to reduce your taxable income by $1000 - which will reduce your tax bill by a lesser amount (if you are in the 15 percent tax bracket, you only save $150).

P.S. Some people argue that refundability does not necessarily mean redistribution since the people getting the handouts usually pay other taxes, most notably payroll taxes for Social Security and Medicare. But this makes no sense. It is akin to arguing that food stamps aren't redistribution because there are all sorts of taxes built into the price of food.

Besides, the goal should be to shift payroll taxes to personal retirement accounts, not to cancel out those taxes with new spending.

No comments:

Post a Comment