During his time in the White House, Donald Trump pursued very good tax policy and very bad spending policy.

So if he wins a second term, one would hope he maintains his approach on taxes and changes his approach on spending.

Unfortunately, he is doing the opposite. He has said nothing to suggest he will control spending, but he has signaled support for some misguided tax policies.

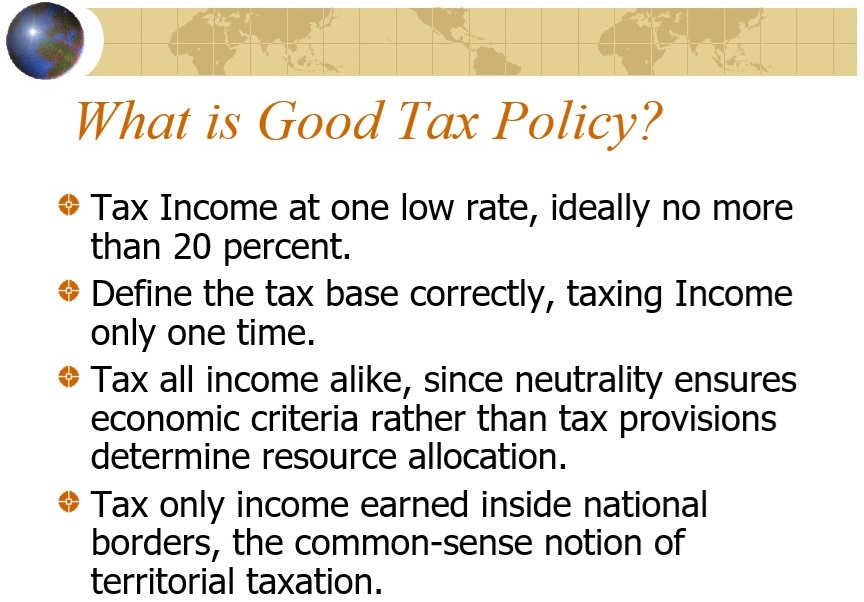

Before getting into the details, here's a slide that I often share when giving speeches on tax policy. It lists the four principles that should guide policymakers.

I usually follow this slide by explaining that these principles describe the flat tax. In other words, tax all income, but only one time, and at a low rate.

For all intents and purposes, this means that tax proposals should be judged by whether they bring us closer to a flat tax or farther away.

The good news is that the major provisions of Trump's 2017 tax bill (a lower corporate rate and restricting the state and local tax deduction) moved us in the right direction.

The bad news is that Trump's two new ideas - tax-free status for tips and Social Security benefits - violate the principles of good tax policy. He's creating loopholes when he should be closing them.

For instance, Alex Muresianu of the Tax Foundation wrote about Trump's plan to exempt tips. Here are some excerpts.

According to a Pew Research survey from 2023, 72 percent of Americans have seen an expansion of tipping expectations over the past five years. While some Americans are certainly frustrated about the trend, one recent policy proposal could make it worse.  Former President Donald Trump has proposed making all tip income tax-exempt. ...it's a poorly targeted change, with the potential for unintended consequences for both consumers and the federal budget. ...By making one type of income (tips) exempt from income tax, while other types of income (most importantly, wages) remain taxable, the proposal would make more employees and businesses interested in moving from full wages to a tip-based payment approach. That would mean more service industries adopting the restaurant industry approach of a list price up front and an expected voluntary tip at the end of the transaction. ....Worse, the exemption itself, and any safeguards added, would add to the complexity of the tax code overall.

Former President Donald Trump has proposed making all tip income tax-exempt. ...it's a poorly targeted change, with the potential for unintended consequences for both consumers and the federal budget. ...By making one type of income (tips) exempt from income tax, while other types of income (most importantly, wages) remain taxable, the proposal would make more employees and businesses interested in moving from full wages to a tip-based payment approach. That would mean more service industries adopting the restaurant industry approach of a list price up front and an expected voluntary tip at the end of the transaction. ....Worse, the exemption itself, and any safeguards added, would add to the complexity of the tax code overall.

Here's some of what Kyle Pomerleau of the American Enterprise Institute wrote about the taxation of Social Security benefits.

Former President Trump recently declared that seniors should not have to pay income tax on Social Security benefits. This...is bad tax policy. ...The tax treatment of Social Security is roughly equivalent to the taxation of private pensions.  Under current law, pensions distributions made from the pre-tax tax contributions of individuals and employers are fully taxed while any distributions out of post-tax contributions are exempt from income taxation. This tax treatment results in these labor earnings being subject to taxation once: either when earned or when consumed during retirement. Social Security benefits are a mix of pre- and post-tax dollars. ...The employer-side contribution is not included in the income tax base and is effectively a pre-tax contribution. The employee-side contribution is included in the income tax base and is effectively a post-tax contribution. ...Completely exempting Social Security benefits from income taxation would worsen basic tax fairness. There is no sound reason why two retirees with identical total pre-tax incomes should have vastly different after-tax incomes due to having different mixes of retirement saving.

Under current law, pensions distributions made from the pre-tax tax contributions of individuals and employers are fully taxed while any distributions out of post-tax contributions are exempt from income taxation. This tax treatment results in these labor earnings being subject to taxation once: either when earned or when consumed during retirement. Social Security benefits are a mix of pre- and post-tax dollars. ...The employer-side contribution is not included in the income tax base and is effectively a pre-tax contribution. The employee-side contribution is included in the income tax base and is effectively a post-tax contribution. ...Completely exempting Social Security benefits from income taxation would worsen basic tax fairness. There is no sound reason why two retirees with identical total pre-tax incomes should have vastly different after-tax incomes due to having different mixes of retirement saving.

Kyle is addressing a complicated topic, but all you need to understand is that it is not a good idea to double tax savings.

This means that all savings should receive IRA or 401(k) treatment. In other words, tax income that is saved and invested just one time. You can tax it one time when it is first earned (like with a Roth IRA), or you can tax it one time when it is consumed (like with a traditional IRA or 401(k).

Just don't tax it two times.

So if we treat Social Security the same way, that means benefits should be 50 percent taxable. Why? As Kyle explained, the portion (50 percent) of payroll taxes paid by employers is from pre-tax income when the portion (50 percent) of payroll taxes paid by employees is post-tax income.

So that means 50 percent of Social Security benefits should be treated as taxable income.

But not zero percent, as Trump proposes (and not 85 percent, as Kyle proposes in his article).

P.S. If Trump's proposals for new loopholes are misguided, what are good ideas? The Tax Foundation article by Alex Muresianu has a very good suggestion.

In the long term, raising wages and employment opportunities for workers across the board should be the goal. The tax policy that would best accomplish that is expensing for capital investment, which would encourage businesses to increase investment and, over time, this would boost worker productivity and wages. It is not a quick fix, but it is the right fix—and it is worth doing even if the impact takes several years to fully materialize.

Alex's proposal for expensing would move us closer to a flat tax, so it's definitely an example of good tax policy. And he's definitely correct in pointing out that such a policy would be good for long-run wage growth.

But I'm ecumenical. I'll applaud any incremental reform that moves us in the right direction.

Sadly, Trump's two new ideas don't qualify. And it goes without saying that Kamala Harris' class-warfare agenda is even worse.

No comments:

Post a Comment